Investment Lifecycle

Maple Leaf Short Duration Flow-Through offers investors an opportunity to invest in a professionally managed and diversified portfolio of flow-through shares of resource companies. These flow-through shares are issued by companies in the mining and energy sectors and are available to individual and corporate investors by way of Maple Leaf Short Duration Flow-Through Limited Partnerships.

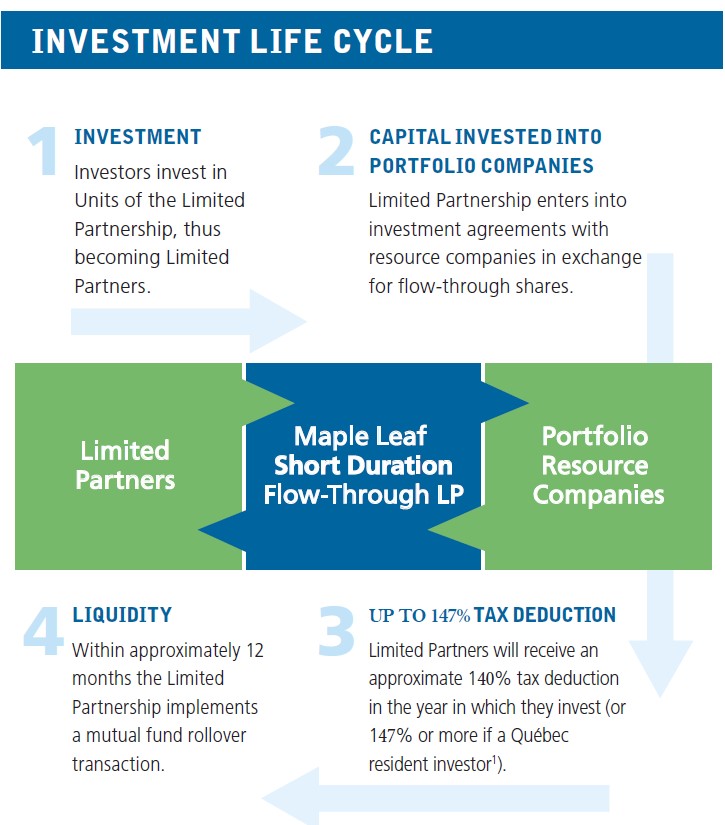

The diagram below illustrates the lifecycle of an investment in the Limited Partnership and the relationship among investors and the resource companies in which the funds invest.

Investors purchase Units in a Maple Leaf Short Duration Flow Through Limited Partnership which is a fund whose mandate is to provide capital appreciation through a diversified portfolio of resource stocks. Investors also benefit through the realization of tax savings of up to 147% of the amount invested. The tax savings are applicable to income from employment, business or property. Through investing in a flow through Limited Partnership, investors are able to defer the payment of tax on income until sometime in the future – when the flow through shares are liquidated – at which time the sale proceeds will be taxable in the hands of investors at the more favorable capital gains tax rate.