About Development Drilling

| | |  |

Lower Risk Development Focus | |

| Maple Leaf Oil & Gas Royalty Income programs geologists and engineers focus on investing in development or "in-fill" wells and do not finance the drilling on any high risk wildcat wells. Government Regulated Proven Pools -

Using

current government regulated production data from already producing

wells, along with seismic reading equipment, it has become much easier

to determine the ideal location to drill for subsequent "in-fill" wells. Oil and Gas Companies with a Development Drilling Target

| |

Well Understood Development Drilling Programs

can Create Value for Investors

Oil and gas companies undertake two types of drilling; exploration or development. Development drilling offers substantially less risk.

Key Advantages of Development Drilling

- Development drilling means drilling into an already existing and producing pool of oil and/or gas.

- 85% average success rate in development drilling vs. only 10% average success rate for exploration drilling.

- Infrastructure (i.e. pipelines) and processing facilities are generally already in place to facilitate tie-in of production and paying investors income as soon as possible.

| | | |

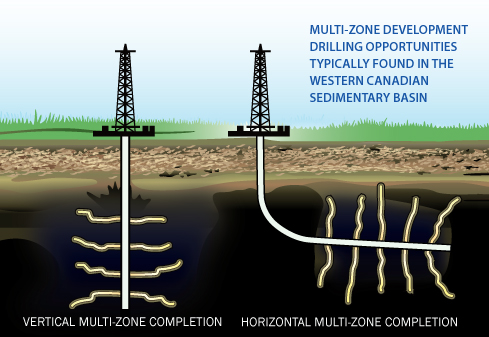

Diversification Through Technology | |  |

| Maple Leaf Oil & Gas Royalty Income programs provide diversification through key geographical areas and multi-zone development drilling. |

WHAT ARE SOME OF THE RISKS OF THESE TYPES OF PROGRAMS?

- Drilling wells can be

viewed as risky, however the partnership has mitigated this risk by

targeting development wells, which typically achieve a success rate in

excess of 85%, rather than exploration wells.

- Well performance, i.e. the actual daily volume of production achieved from a well and its

estimated reserves of oil and natural gas, can vary from pre-drill

projections.

- Commodity price volatility.

One important factor that significantly mitigates risk is the 100% tax deduction (over time) that the investors realize from participation in Maple Leaf Oil & Gas Royalty Income programs. This tax deduction returns back to investors approximately 40% of their investment from their tax savings.

Investment Lifecycle

Maple Leaf Oil & Gas Royalty Income programs can provide investors up to a 100% tax deduction (over time), monthly income, liquidity and the opportunity to convert income into capital gains.

View Investment Lifecycle

View Investment Lifecycle